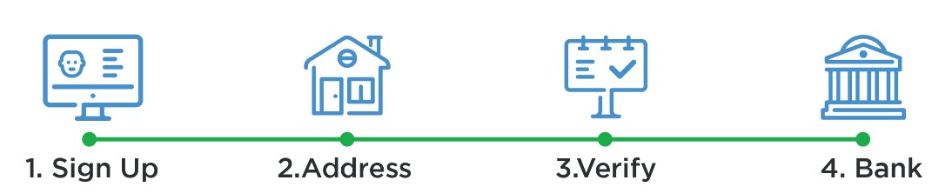

P2P Financing’s Application or Re-application Flow

Whether you are

- New and first-time client

- Our existing issuer and still serving the repayment

- Former issuer

- Rejected applicant (more than six months)

You may apply/reapply anytime, anywhere, with zero cost (except new and first-time application companies). The P2P application is as simple as 10 minutes process only.

Step 1: REGISTER & VERIFY

Log in to www.alixco.com and register as VERIFIED Alixco’s member.

To get verified as an Alixco member, make sure you provide clear and coloured images of your

- IC copy (back and front)

- One Selfie holding your IC

- One page of any bill or statement (i.e. bank statement, credit card statement, telco, or any utility bill) that shows your name and address

STEP 2: Upload and Fill-up

Go to “get financed” and fill up all the requested and stipulated information and documents.

STEP 3: Make payment and Submit Consent Letter (only apply to new and first-time applications)

For all new clients, you should expect to get an email from p2p@alixco.com about the RM200 application and due diligence fees, and a consent letter of credit background check template to be filled up.

Why do I need to pay RM200? What do I get if I fail the application?

Note: Alixco imposed non-refundable, one-time off RM200 to all new and first-timer p2p applications. We conduct a new client's thorough and stringent credit and business diligence. You should also expect to obtain details of your company and all director’s credit reports with analysis upon submission of consent letter on the credit check. All the failed applications may also request free and professional credit analysis and know why Alixco’s credit expert rejected your application.

STEP 4: Alixco’s Due Diligence

Alico team will be in touch and conduct an online interview and site check on your business. Approval and offer letter or rejection email will be given within 3– 7days upon complete submission of all the information and documents requested during or before an online interview.

STEP 5: Campaign Go Live

Your P2P campaign will go- live online for the crowd to invest (i.e., crowdfunding) within 1-2 days upon the agreement of the offering by Alixco by signing back the offer letter. Depending on the interest rate, tenure, and funding amount, so far, all of the campaigns listed by Alixco are 100% fully funded in a few minutes to a few days.

STEP 6: Fund Disbursement

P2P agreement and personal guarantor contract will be sent and signed back with hard copy submission to Alixco at your soonest, so the fund will be instructed to release to your company’s bank account within 24 hours upon receiving the post-dated cheques and signed documents.

P2P as alternative and digital financing for Malaysian SMEs

In summary, it takes six steps and 2-3 weeks for a successful funded P2P application (i.e., fund in your bank account). Business owners are advised to apply P2P 1-2 months earlier of your foreseen shortage of cash flow situation. Since P2P is fast and flexible to get approval and funding, it can serve as an alternative financing solution to bridge or substitute your bank loan. You may also use it as invoice financing mechanism for purchasing more stocks hence increasing your business’s revenue.