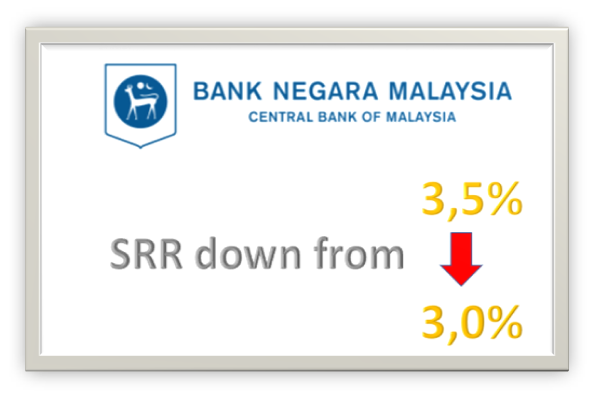

In case you have missed it out: Bank Negara Malaysia announced that the Statutory Reserve Requirement (SRR) Ratio will be lowered from 3.50% to 3.00% effective from 16 November 2019.

Its the first cut in more than 3 years.

According to the BN website, the SRR rate is the proportion that banking institutions are required to maintain balances in their Statutory Reserve Accounts (SRA) equivalent to a certain proportion of their eligible liabilities (EL).

"The decision to reduce the SRR is undertaken to maintain sufficient liquidity in the domestic financial system. This will continue to support the efficient functioning of the domestic financial markets and facilitate effective liquidity management by the banking institutions.

The SRR is an instrument to manage liquidity and is not a signal on the stance of monetary policy. The Overnight Policy Rate (OPR) is the sole indicator used to signal the stance of monetary policy, and is announced through the Monetary Policy Statement released after the Monetary Policy Committee meeting." the central bank said.

http://www.bnm.gov.my/index.php?ch=en_press&pg=en_press&ac=4948&lang=en

Alixco P2P Finance, SME P2P Lending Malaysia