Summary

Join SWC Retail Chains' equity crowdfunding campaign to invest in a rapidly growing market disruptor, poised to transform the landscape of affordable household goods with a 280% revenue increase since 2017 and strategic expansion plans underway.

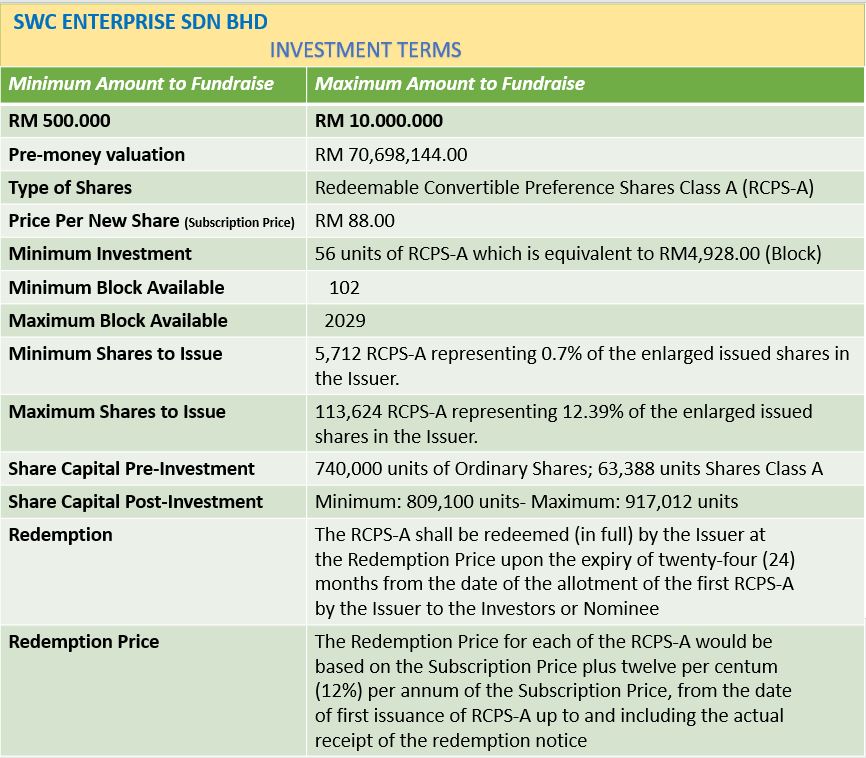

Pre-money valuation:

RM 70,698,144

Target fundraise:

RM 500,000 (minimum)

RM 10,000,000 (maximum)

Equity on offer:

0.7% (minimum)

12.39% (maximum)

Share price:

RM 88.00

Minimum Investment RM 4928.00 equivalent to 56 shares (RCPS)

Investment Return:

Twelve per centum (12%) fixed internal rate of return per annum of the Subscription Price and 24 months redemption

Please refer to the term sheet for a detailed overview

- Explosive Growth Since First Crowdfunding: SWC Retail Chains has experienced an astounding 280% increase in revenue, soaring from RM 30 million in 2017 (first ECF) to over RM 94 million in 2023. Our profit has surged 20-fold, exceeding RM 5 million per year, a testament to our financial stability and growth potential.

- Market Transformation: Our vision is simple yet powerful—to transform the market for affordable household goods, restaurant, and hawker supplies by offering unique, budget-friendly products not available from our competitors.

- Strategic Expansion: With a strategic approach, we have expanded our presence to 55 stores and are set to open 10 more outlets shortly. Our effective location strategy places us in urban neighborhoods where our competitors are scarce, creating a strong competitive advantage.

- B2C and B2B Demand: We are witnessing increasing demand from both B2C and B2B customers. To meet this demand, we have established three strategic warehouses to support our retail outlets, ensuring timely and efficient supply chain management.

- Experience: More than 16 years’ experience in supplying to various commercial F&B kitchens

- Upcoming Projects: SWC is committed to innovation and growth. We have exciting projects on the horizon, including the opening of new retail stores in Johor Bahru, Penang, and Ipoh. These projects will further solidify our position as a market leader.

Document Download

Please download Investment Term Sheet SWC for further informations

ECF investor type criteria under SC guidelines

Investor Proposal

Accredited and sophisticated investors can choose to support the campaign with a higher amount.

A Nominee Structure will be chosen for all contributions to this campaign. Please read the entire investment term sheet.

SWC-ECF Video

Campaign Deatails

Problem: Customers have long been burdened with limited options and high prices when it comes to household goods, restaurant, and hawker supplies. Existing competitors fail to offer the variety and affordability that the market craves.

Solution: SWC Retail Chains is addressing this problem head-on by providing 'More Variety At Lower Prices!' Our focus on cost-effective, high-quality household utensils positions us as the low-price leader in the mass market of household goods, revolutionizing the industry.

Market & Growth: We operate in a market with substantial untapped potential. As the demand for affordable household goods and restaurant supplies continues to rise, SWC is strategically positioned to capture a significant market share. Our steady growth trajectory reflects the vast opportunity that lies ahead.

Competition: While there are competitors in the market, our unique value proposition, effective location strategy, and commitment to affordability set us apart. We are confident in our ability to maintain and strengthen our competitive edge.

Use of Funds: The funds raised through this equity crowdfunding campaign will primarily be allocated towards the expansion of our retail presence in Johor Bahru, Penang, and Ipoh. Additionally, we will invest in marketing initiatives to further enhance brand awareness and customer engagement.

Investors and Funding: We invite you to become a part of our success story. Your investment will not only contribute to our growth but also position you as a stakeholder in a company with a proven track record of profitability and innovation. Together, we can reshape the market for affordable household goods and restaurant supplies.

SWC Enterprise core team

As a 36-year-old entrepreneur, Simon Heng is the founder and CEO of SWC Enterprise Sdn Bhd since 2008. His judgement made him decide to focus on rural areas’ markets, evolving his brand to a tangible reality with a total of 50 outlets in West Malaysia.

Mr. Eddie Chia Meng Yat, age 68

Ms. Eve Chuah Shi Shi, age 33

Ms. Jane Lee Choy Chuen, age 41

Ms. Lim Lai King, age 60

Target Market

SWC’s key target market are individual middle income consumers in Malaysia and corporate clients in the F&B industry, in particular restaurants, hawker stalls and catering services. SWC currently has an estimated 11 000 unique customers in the Kuala Lumpur region.

Approximately 30% of individuals fall into the middle income bracket SWC is targeting. With approximately 11 million people living in Selangor and its surrounding (Pahang, Negeri Sembilan and Perak), SWC’s immediate target market is at approximately 30% of that population, coming down to about 3.5 million. SWC aims to capture at least 10% of this market i.e. >300 000 individuals.

Compettive Landscape

The competitive landscape in the household/kitchenware sector is marked by several players:

MR DIY: 900+ stores, presence in all 14 states across Malaysia

DAISO : A Japanese company with over 29 stores across Malaysia

ACE Hardware: 24 stores across Selangor, KL, Perak and Penang

Unique differentiator from competitors

SWC has positioned itself uniquely to offer customers ‘More Variety At Lower Price!’, meeting their requirements by delivering the most cost-effective quality household utensils into their premises. It aims to be the low-price leader in the mass market of household utensils.

SWC has positioned itself uniquely to capture demand in urban neighbourhoods where such stores are not yet available. It seeks to offer the consumer an easily accessible store concept in close proximity to their households.

Company revenue streams

In store sales (E-Commerce to be added soon):

Kitchenware (50%)

Houseware (30%)

Hardware (20%)

Return on Investment

-

Redemption: The RCPS-A may be redeemed (in part or full) by the Issuer at the Redemption Price upon (“Redemption Event”):

(i) Passing of ordinary resolution through members meeting or members circular resolution and

(ii) after 24 months from the date of the allotment of the RCPS-A by the Company. - Redemption Price : The Redemption Price for each of the RCPS-A would be based on the Subscription Price for the RCPS-A plus an amount equals to twelve per centum (12%) fixed internal rate of return per annum of the Subscription Price, from the date of first issuance of RCPS-A up to and including the actual receipt of the redemption notice subject to:

(i) proportional adjustment for stock splits, stock dividends, subdivision and/or any analogous event and

(ii) adjustment on a broad base basis in the event that the Issuer issues additional ordinary shares (or convertible securities to ordinary share) at a lower price or valuation than the price paid by the ECF Investors.

-

Preferential Dividend : RCPS-A holders shall be paid dividend in preference to the holders of the ordinary shares and shall be pay-out as declared by the Company (on as if converted basis). The balance dividend shall be distributed on a pro rata basis to holders of ordinary shares.

-

Liquidated Preferences : In the event of Liquidation, the ECF Investors shall be entitled to receive one times (1x) the Subscription Price in preference to the holder of ordinary shares.

Any surplus funds and/or assets of the Company after payment to the RCPS-A holder, which are legally available for distribution, shall be distributed on a pro-rata basis to the ordinary shareholders.

Investment Terms

Disclaimer

Important Notice

Please be advised as follows:

(a) No shares will be allotted or issued based on this document after six months from the closing of the offer period.

(b) This document has not been reviewed by the Securities Commission Malaysia. The Securities Commission Malaysia does not recommend nor assume responsibility for any information including any statement, opinion or report disclosed in relation to this fundraising exercise and makes no representation as to its accuracy or completeness. The Securities Commission Malaysia expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the information disclosed.

(c) This issue, offer or invitation for the offering is a proposal not requiring authorisation of the Securities Commission Malaysia under section 212(8) of the CMSA 2007.

Disclaimer 2

- Alixco, along with its management and team, may participate in this crowdfunding campaign as investors.

-

We would like to inform you about your cooling-off period rights: ECF investors are given a six business days cooling-off period, within which they may

withdraw the full amount of their investment. If you wish to do so, you may do this via your user account or by contacting us via email within that period. - SWC Enterprise Sdn Bhd has previously raised funds via an ECF campaign with FBM Crowdtech Sdn Bhd amounting to approximately RM 3 million.

- SWC Enterprise Sdn Bhd has also been raising funds on Alixco's (FBM Crowdtech Sdn Bhd's) P2P platform, including its subsidiaries and associated companies such as SWC Enterprise Sdn Bhd's founder's related companies, namely Cheap2Shop, SWC Properties Sdn Bhd and De Dyno Sdn Bhd with scheduled upcoming repayments of approx. RM 5 million

IMPORTANT RISK WARNING:

Please read carefully. Investors who are not in full agreement with each statement MUST NOT invest in any Equity Crowdfunding campaign!

I understand, agree and accept that investments in Equity Crowdfunding Campaigns carry a high degree of risk and may result in the loss of your entire investment.

I understand, agree and accept that the value of your investment in an Equity Crowdfunding Campaign may fluctuate and can be affected by various factors, including market conditions, economic trends, and the performance of the company.

I understand, agree and accept that Equity Crowdfunding Campaigns typically involve early-stage or emerging companies, which often have limited operating histories, unproven business models, and uncertain prospects for future success.

I understand, agree and accept that there is no guarantee that the company seeking funding through an Equity Crowdfunding Campaign will achieve its objectives or generate returns for investors. Many startups and small businesses fail, and you may lose all of your invested capital.

I understand, agree and accept that investments in Equity Crowdfunding Campaigns are illiquid and may be difficult or impossible to sell before the company is acquired, goes public, or ceases operations. You should be prepared to hold your investment for an extended period, often years or decades, with no expectation or guarantee of liquidity or return. The success of an Equity Crowdfunding Campaign depends on various factors beyond the control of the investor, including changes in regulations, industry dynamics, competitive pressures, and technological advancements.

I understand, agree and accept that before making an investment in an Equity Crowdfunding Campaign, I should carefully review all available information about the company, its management team, business model, financial condition, and risk factors disclosed in the offering documents.

I understand, agree and accept that it is advisable to consult with a qualified financial advisor and legal professional and tax advisor before investing in an Equity Crowdfunding Campaign to ensure that I fully understand the risks involved and to evaluate whether the investment is suitable for your financial situation and investment objectives. I understand, agree and accept that I must not invest in Equity Crowdfunding Campaigns if I am not legally allowed to do so e.g. by the regulations of my country / nationality / place of residence or unique personal circumstances.

I understand, agree and accept that I must pay tax on the returns of your Equity Crowdfunding investments.

I understand, agree and accept that the inherent risks associated with early-stage investing and understand that there is no guarantee of profit or protection against loss. I also understand, agree and accept that FBM Crowdtech Sdn Bhd or its associates shall not take any resposibility of liability for any loss of investment and any associated direct, indirect, incidental or consequental damages associated with it. I understand, agree and accept that it is solely my resposibility to make an investment decision with the associated risks.

I understand, agree and accept that I should only invest funds in an Equity Crowdfunding Campaign that you can afford to lose without adversely affecting my financial situation or lifestyle. I must not invest money that you cannot afford to lose.

I understand, agree and accept that while FBM Crowdtech Sdn Bhd scrutinized each deal before being hosted on the platform, no warranty or guarantee can be given with regard to the accuracy of the information provided by issuers and FBM Crowdtech Sdn Bhd shall not take any resposibility of liability any associated direct, indirect, incidental or consequental damages. I understand, agree and accept that FBM Crowdtech Sdn Bhd operates only as a market operator - a "platform" or "middleman" - that connects companies looking for funds with potential investors.

I understand, agree and accept that if I am a Retail investor (important: refer to your account status and to the FAQ), I am only allowed to invest a maximum of RM5,000 for a single investment and and no more than RM50,000 within a 12-month period. If I am an angel investor, I am only allowed to invest up to RM500,000 within 12 months.

I understand, agree and accept that even though FBM Crowdtech Sdn Bhd carefully reviews the information of this pitch, no warranty or liability can be given with regard to the accuracy of the information provided and any direct, indirect, special or consequestial or incidental damages as a part of it, especially with regard to information provided by the issuer over which FBM Crowdtech Sdn Bhd has few means of oversight.