What the business is about?

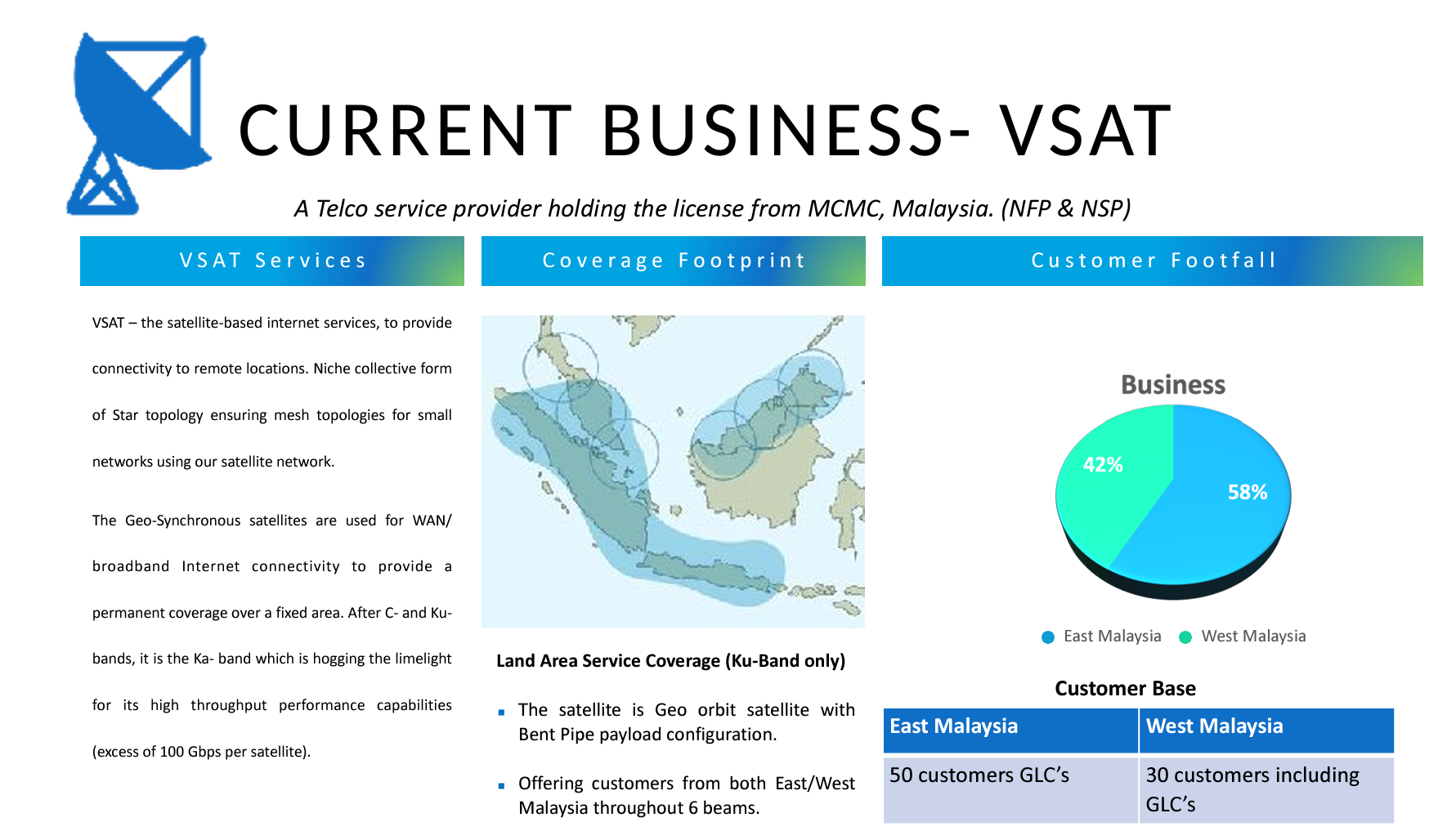

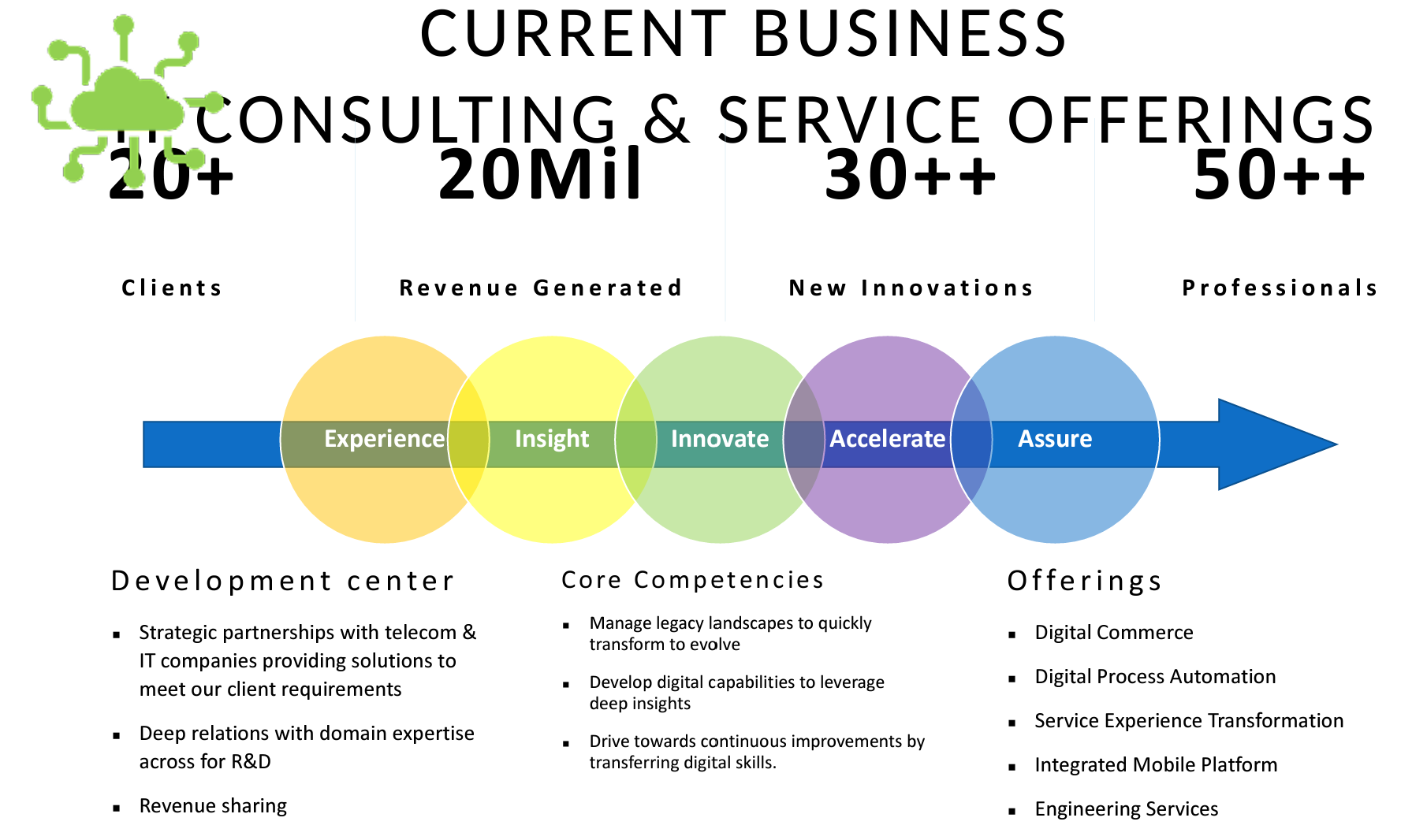

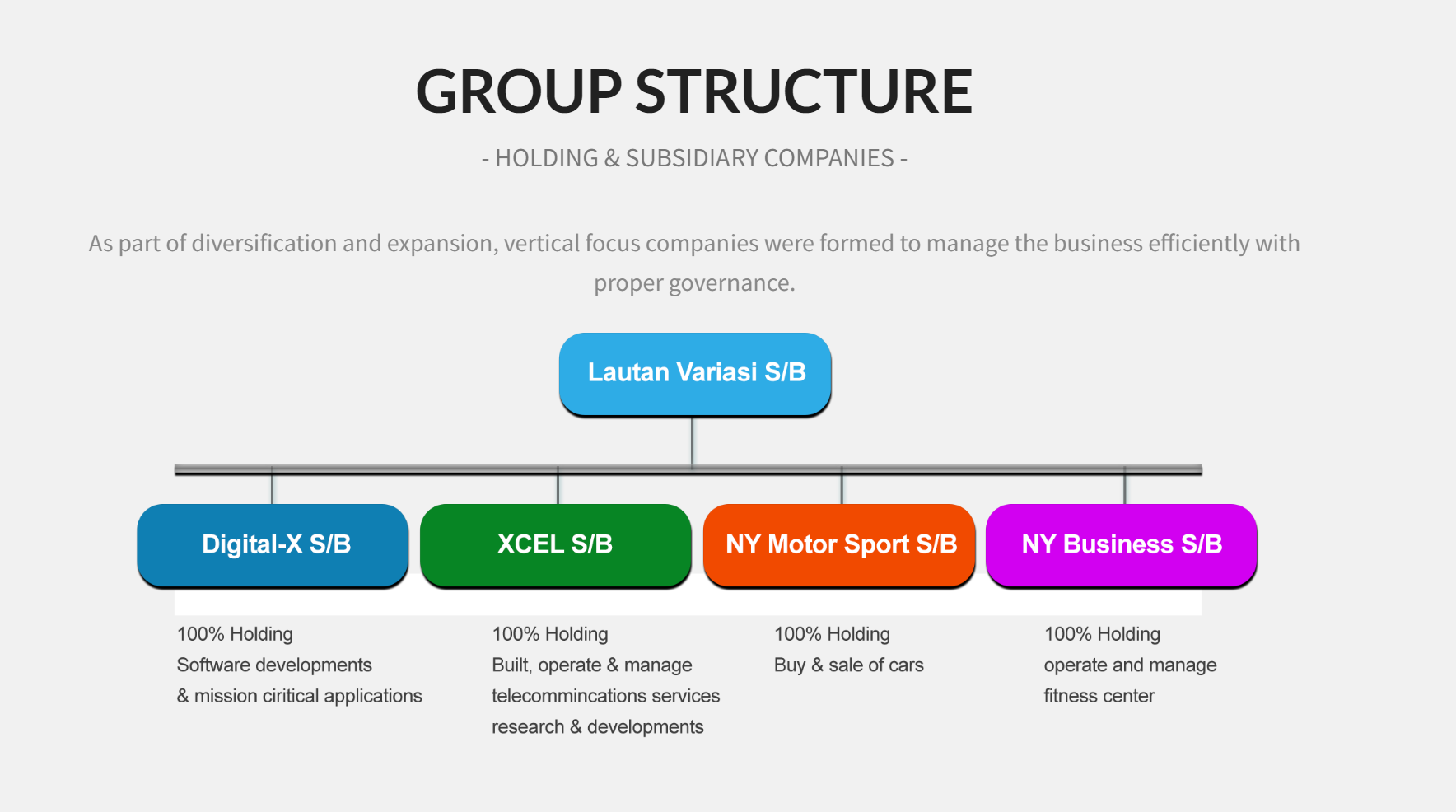

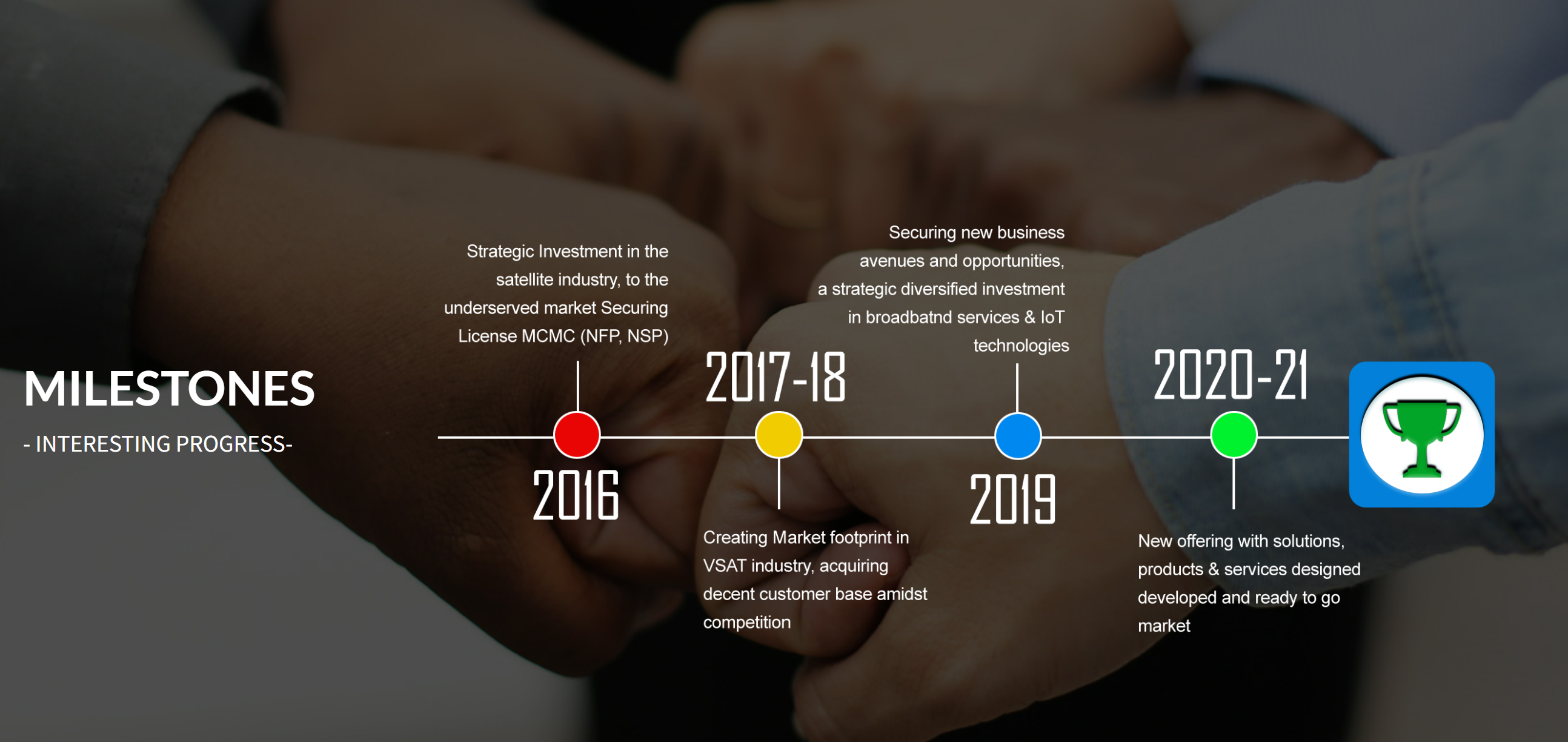

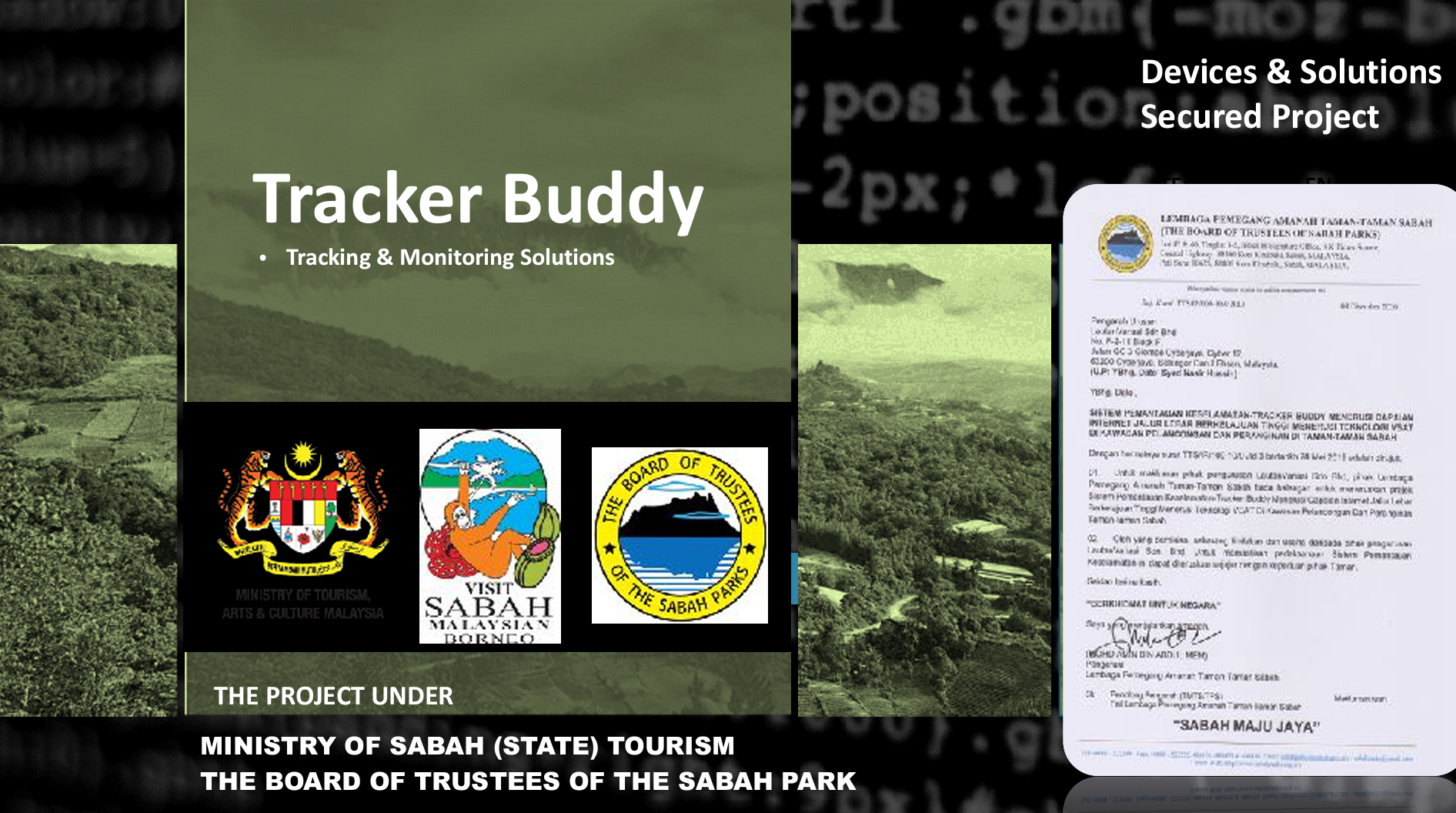

Lautan Variasi Sdn Bhd, "incorporated business in August 2015, as a wholly Bumiputera-owned company, to provide an end-to-end licensed Telecom and Broadband Network services Operator using VSAT. In terms of the economics of this evolution, our revenue since 2016 has being always on the up trend which has prompted us to invest consistently in research & development. Our investments in technology partnership has brought various achievements and helped us to make a breakthrough in offering wide range of end user services.

The promise of “quality connectivity” has become a reality faster than many of us expected. The evolution of our business model across the digital divide has shifted in our favour more quickly than we forecasted, resulting more upside in the business than ever before domestically."

In 2022, Lautan Variasi Sdn Bhd had a revenue of RM 12,243,764.00 and a profit after tax of RM 1,445,317.00.

This is Lautan Variasi Sdn Bhd's 1st investment note with Alixco.

This investment note is secured by 3 personal guarantees, as required by ALIXCO P2P Financing.

For what will you use the funds?

The funds will be used for working capital.

Business Overview

Business

Funding amount

RM 500,000.00 for 6 months.

14.16 % interest (nominal, p.a.)

Business type

Sdn Bhd, Telecommunication

Location

NO. F-2-11 BLOCK F JALAN GC 3 GLOMAC CYBERJAYA, CYBER 12 63200 CYBERJAYA SELANGOR

Number of outlets

1

Number of directors

2

Personal guarantees

3

Year of incorporation

2015

Number of employees

50

Important Risk Information:

The risk score of CAA2 (‘High risk’) was determined by a blend of our internal risk-based pricing algorithm, an external risk score from a leading credit rating agency and a variety of qualitative factors. It is an approximation only and does not guarantee any specific outcome. Our risk score ranges from A(‘lower risk’), B(‘medium risk’), C(‘medium-high risk’) to D(‘high risk’).

Risk score of CAA2 (‘higher risk’) indicates that this investment amount has an elevated-high level of risk. .

In 2022, Lautan Variasi Sdn Bhd had a revenue of RM 12,243,764.00 and a profit after tax of RM 1,445,317.00.

Alixco charges investors 1% on total repayments (for 6 months investment notes) only if and when repayment occurs.